Introduction

When it comes to financial matters, the term “being in the ” carries significant weight. But what does it actually mean? In this comprehensive guide, we will explore the meaning of “being in the red” and delve into its implications on personal and business finances. From its origins to its modern-day usage, we will unravel the layers of this financial phrase and shed light on its importance. So, let’s dive deep into the world of being in the red!

What is Being in the Red?

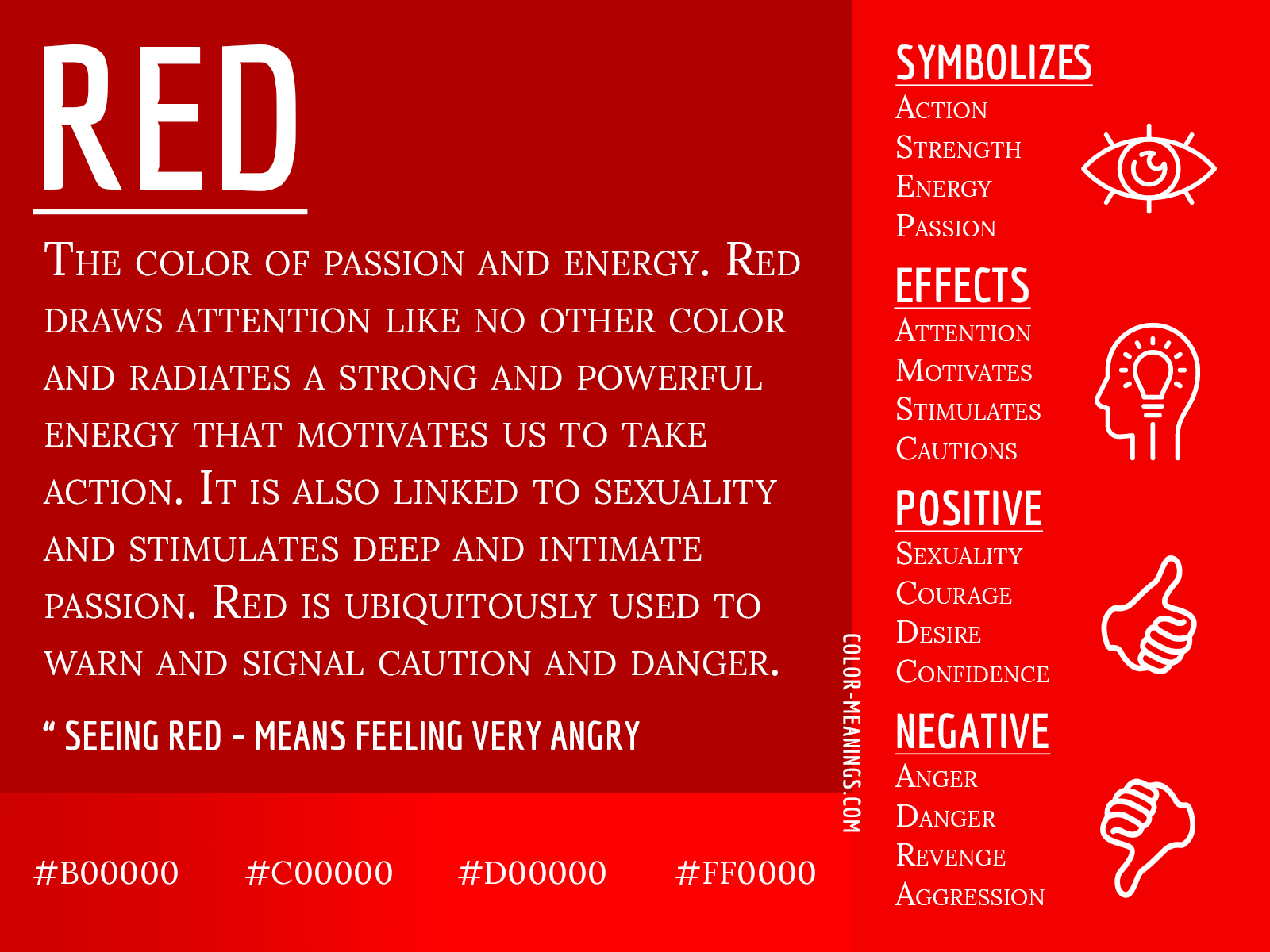

The phrase “being in the red” is an idiom used to describe a financial situation where an individual, organization, or business has negative funds or is operating at a loss. It originates from the traditional bookkeeping practice of using ink to indicate negative values on financial statements. In contrast, black ink was used to represent positive values or profits.

The Origins of Being in the Red

The origins of the phrase can be traced back to the early days of bookkeeping. In manual bookkeeping systems, accountants would use physical ledgers to record financial transactions. The use of ink to indicate losses or negative balances served as a visual cue for accountants and financial professionals. This convention made it easier to distinguish between positive and negative values at a glance.

The Significance of Being in the Red

Being in the red carries significant implications for individuals, businesses, and the overall economy. Understanding its significance is crucial for financial planning and decision-making. Here are some key points to consider:

- Financial Distress: When someone or something is in the , it implies financial distress or a lack of profitability. This situation can result from various factors such as overspending, poor financial management, economic downturns, or unexpected expenses.

- Cash Flow Problems: Being in the red often indicates cash flow problems, where expenditures exceed revenues. This can lead to difficulties in meeting financial obligations, such as paying bills, loans, or employee salaries.

- Debt Accumulation: Continued losses or negative cash flow can result in accumulating debt. This can lead to a debt spiral, making it increasingly challenging to recover and return to positive financial territory.

- Business Viability: For businesses, being in the red raises concerns about their viability and sustainability. It can affect their ability to secure financing, attract investors, or compete in the market.

How to Avoid Being in the Red

While being in the red can be a challenging situation, proactive measures can help individuals and businesses avoid or mitigate its impact. Here are some strategies to consider:

- Budgeting and Financial Planning: Creating a realistic budget and adhering to it is crucial. Proper financial planning allows for better control over expenses and helps identify potential financial risks.

- Expense Control: Keep a close eye on expenses and identify areas where cost reductions can be made. By optimizing spending habits, it is possible to increase cash flow and avoid being in the red.

- Diversify Income Sources: Relying on a single source of income can be risky. Diversifying income streams, such as through side businesses or investments, can provide additional financial stability and reduce the chances of being in the red.

- Emergency Fund: Significance and Implications Building an emergency fund serves as a safety net during challenging times. Having a reserve of funds can help cover unexpected expenses and prevent the immediate plunge into negative financial territory.

FAQs about Being in the Red

Q: What are the consequences of being in the red?

A: Being in the red can have several consequences, such as financial distress, cash flow problems, debt accumulation, and doubts about business viability. It can lead to challenges in meeting financial obligations and hinder future growth and financial stability.

Q: How long does it take to recover from being in the red?

A: The time it takes to recover from being in the red varies depending on the specific circumstances and the actions taken to address the situation. Recovery can take months or even years, depending on factors such as the severity of the financial distress, the effectiveness of financial planning, and external economic conditions.

Q: Can being in the red be a temporary situation?

A: Yes, being in the red can be a temporary situation. With proper financial management, strategic planning, and the implementation of corrective measures, it is possible to turn negative balances into positive ones and regain financial stability.

Q: Is being in the red always a bad thing?

A: While being in the red generally implies financial difficulties, it is not always a definitive indicator of failure. In certain cases, short-term losses may be part of a strategic investment or expansion plan. However, prolonged periods of negative financial performance require careful attention and prompt action to avoid severe consequences.

Q: How can businesses recover from being in the red?

A: To recover from being in the red, businesses need to assess their financial situation, identify the root causes of the negative performance, and develop a comprehensive recovery plan. This may involve cost-cutting measures, revenue generation strategies, refinancing options, and seeking professional advice from financial experts.

Q: What lessons can be learned from being in the red?

A: Being in the can provide valuable lessons in financial management, resilience, and adaptability. It emphasizes the importance of proactive planning, risk assessment, and prudent decision-making. By learning from the experience, individuals and businesses can develop stronger financial strategies and mitigate future financial challenges.

Conclusion

Being in the red holds a profound meaning in the world of finance. It signifies financial distress, negative balances, and the need for immediate action. Whether on an individual or business level, being in the red demands careful attention, strategic planning, and the implementation of corrective measures. By understanding the implications of this financial term and taking proactive steps to avoid or recover from it, individuals and businesses can achieve financial stability and navigate the complex world of finance more successfully.